Automated Teller Machines (ATM)

Automated Teller Machines (ATM) have revolutionised banking and made life easier. Bank customers can now withdraw money from their account anytime and anywhere in the country or even in the world.However , like any electronic gadgets, they can also malfunction when not serviced properly. Besides software and hardware glitches, factors like operator errors, power failure, voltage variations can result in ATM malfunctioning. And when that happens , consumers can be in a frustrating experiences.

.

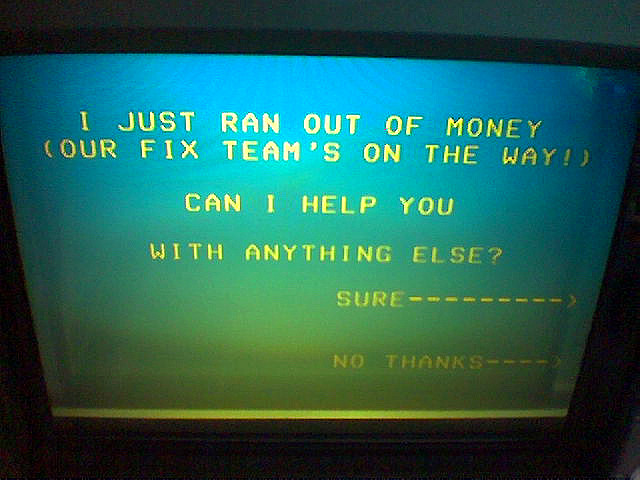

Imagine this scenario: You are travelling in another city and dependent on your ATM card for cash requirements. You insert the card , but the machine just gobbles it up , leaving you high and dry - with no cash and no hope of recovering the card in the immediate future. "Or you are timed out" or " Your transaction has been cancelled" or " Bank communication failed. "Please try after some time " or "Temporarily unable to process". You the haunt for another ATM and for all you know , that may also be out of service or short of cash. In fact consumers complain that on Sunday's, ATMs have been found to have no cash . Long queues in front of ATMs are also a common sight , particularly when the cash is being refilled or the machine is being repaired.

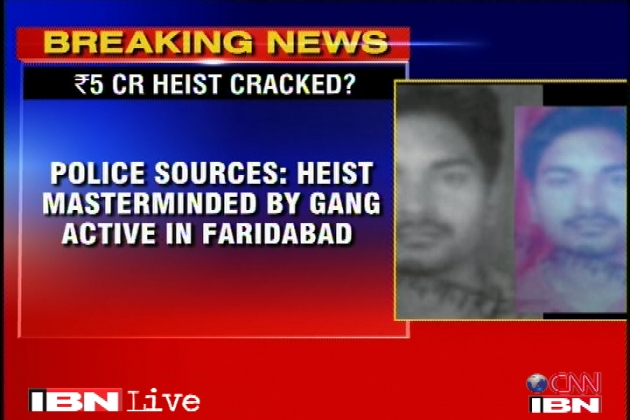

Most Consumer complaints refer to the machine refusing to give them any money , even though the transaction slip indicates that the money has been withdrawn . There are also cases of transaction slip indicates money has been withdrawn . There are also complaints of illegal withdrawal - passbooks showing withdrawal from ATMs, without the consumer having done so. And invariably , rectifying these faults can be frustrating for the consumer. It's time banks improved ATMs , ensured that there are no cash dispensing errors and that they gave consumer trouble free service. Or else they may well be hauled up before the consumer courts. There is another related issue - fraud or robbery . As criminal gangs acquire sophisticated gadgets to get at card numbers and Personnel Identification Numbers (PIN) , banks and manufacturers are thinking of ways and means of making ATMs , more secure. It is estimated that is United States about $50 million are lost annually on account of ATM related frauds.

In India , robberies outside ATMs are on the rise. In cities like Bangalore , consumers have been waylaid outside ATMs and forced to withdraw large amount of money at gun-points. In the case of Col D.S. Sachar Vs Punjab and Sind Bank (RP on 1046 of 2003), the apex consumer court made it clear that not providing adequate security to customers constituted deficiency in the service rendered by banks and where such deficiency caused the consumer loss or suffering , banks were liable to pay. So it's time banks should tightened security near ATMs.

Like it on Facebook, Tweet it or share this article on other bookmarking websites.